Sandra Valentine: Posted on Wednesday, November 06, 2013 12:58 PM

So here we are facing yet another year approaching its end. Are you tired of making the same New Year’s Resolution EVERY year (which means you never realized your resolution to begin with, otherwise, you’d have a different one right)?

So here we are facing yet another year approaching its end. Are you tired of making the same New Year’s Resolution EVERY year (which means you never realized your resolution to begin with, otherwise, you’d have a different one right)?

Sometimes people just need a “how to†guide. In our financial world which let’s be honest, usually rules our lives as so many things are dependent on it, many find themselves on a treadmill where they walk, and run and still find themselves in the same spot. Sound familiar? We’ve all been there. One of the most popular and life damaging spirals we can find ourselves in is DEBT.

It may be just four letters, but I promise you, it should not be taken lightly and for individuals who are in hight debt and are spiraling out of control, know first hand that DEBT, is not prejudice; it consumes anyone that will allow it to.

So what is a person to do? There are two answers: Debt prevention and debt elimination. Let’s examine these two scenarios as everyone falls into one of them. If you fall under the later one then you really need to listen up!

Debt prevention is obtained when you realize that credit cards are not money. Credit cards exist for emergencies and truly to test your self-control to lenders. Prospective Lenders like to see that although you may have a $10,000 credit line on a credit card, your balance is only $1000 or even less. Why? Simply because it shows that although you have access to it, you’re not compulsive and overspend (a characteristic of a good risk candidate for credit). This ratio is called “utilization ratio†and will affect your score in a positive manner when your balances are low (under 30%). The opposite is true when you have a credit card and it’s “maxed out†as it interpreted that not only you may have a tendency to be a compulsive buyer, but that you don’t have the income to make payments larger than the minimum and swooosh your credit score drops! (In case anybody has wondered why they can’t get a credit line increase and they always make their payments on time (but carry a high utilization ratio) this is why.

Think about it. If you lend someone money and they seem to have some difficultly paying it back to you, would you give them more? Well, lenders and banks think in those same lines. If you have a $500 credit card and it’s maxed out often, the bank will be reluctant to give you a higher credit line assuming you’re going to continue with that same pattern of behavior and you may reach a limit and not be able to pay it back, therefore they will not raise your credit limit. Some people truly just don’t know the dynamics. I’ve had clients that thought that by using their cards to the max and making payments was a good thing as the bank is making money from their interest. Yes, banks do charge you interest, but realize that the merchant (whoever accepts payment from a credit card holder) is also paying the bank in the form of merchant fees for every transaction based on a percentage of the charge, so SAVE your money (interest) and your credit by not overspending or allowing high balances on your credit cards.

People that maintain their utilization ratio low have a tendency to NOT overspend. With the holidays approaching, millions of people will spend all of next year paying for these upcoming Holiday such as Thanksgiving, Black Friday, Christmas, Hanukkah, and New Year. Ask yourself one simple question EVERY time you reach for plastic: Do I really NEED this right NOW. Need is not the same as want and can it honesty wait? If you keep true to yourself and practice asking yourself if you really NEED something before you buy it, you’ll be amazed how many times the answer is NO. It’s called being responsible.

So if you’re not exercising self-control and being responsible then what are you doing?

Being irresponsible â€Ewe†how crude! But it’s the brutal truth. We can say it’s the pressure of the holidays, the sales,  good buys, any of a million reasons will do, but the bottom line is if you didn’t have that “credit card†would you be buying some of the things you do now? Are you buying things that you want but don’t necessarily need, or buy something today that can wait? If you are, then please STOP! Debt is a load you want to avoid as it can single handily ruin your life! One of the hardest spirals to break is the credit card debt spiral which once started can easily destroy everything you’ve worked so hard for and set you back years from achieving certain goals. There are several ways to deal with this monster.

good buys, any of a million reasons will do, but the bottom line is if you didn’t have that “credit card†would you be buying some of the things you do now? Are you buying things that you want but don’t necessarily need, or buy something today that can wait? If you are, then please STOP! Debt is a load you want to avoid as it can single handily ruin your life! One of the hardest spirals to break is the credit card debt spiral which once started can easily destroy everything you’ve worked so hard for and set you back years from achieving certain goals. There are several ways to deal with this monster.

1) Seek professional help. If you don’t have excellent credit, then seek a reputable credit repair company that will assist you in eliminating debt that appears on your credit that may very well not belong there for several reasons  such as errors, outdated information, active collections that are past their legal statue of limitation to collect, etc…. A good credit repair company will dispute any item on your credit that should not be there for “x†reason and also demand the validity of debt on questionable items.

such as errors, outdated information, active collections that are past their legal statue of limitation to collect, etc…. A good credit repair company will dispute any item on your credit that should not be there for “x†reason and also demand the validity of debt on questionable items.

Remember if a collection agency or creditor cannot be prove the validity of their claim, the item must be removed.

You’d be surprised how many thousands of dollars of debt may be sitting on your credit file which CAN be eliminated! With over 80% of credit bureaus having inaccurate information, I witness it on a daily basis!

2) Pay your bills on time while trying to rescue yourself from the debt spiral make the minimum payments if that is all you can do, but at all costs prevent from paying late as it will adversely affect your credit score.

3) Stop the bleeding (stop spending money that is not truly necessary).

4) Pay off debt. Did you just chuckle thinking to yourself thinking â€yeah how without the extra moneyâ€? I understand your reaction, but that’s where loan acceleration comes in. Fortunately, debt is not the only one without prejudice . Loan acceleration helps anyone, with any type of credit and any type of loan that bears interest. I’ve broken down

loan acceleration in previous posts but here’s the short version of how it works. I use it personally and enroll all my clients whether they purchasing a car or repairing their credit as it’s a vital tool in “stopping the bleeding†and saving a ton of money that can go to much better use.

loan acceleration in previous posts but here’s the short version of how it works. I use it personally and enroll all my clients whether they purchasing a car or repairing their credit as it’s a vital tool in “stopping the bleeding†and saving a ton of money that can go to much better use.

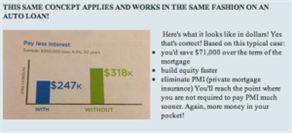

See this example below on a $250,000 mortgage over a standard 30 year mortgage @ 6.5% interest. Using our home acceleration program, your EXISTING monthly payment is simply divided into two smaller biweekly payments that are easier to handle and MATCH your pay dates, (so you’re never strained in making a large payment on the 1st of the month) that may not be at a convienent time of the month .

These bi-weekly payments are automatically drafted from any bank account of preference and is paid bi-weekly to the lender. Interest accrues DAILY and every time you make a payment on loan the interest gets re-calculauted on the descending balance. By having a bi-weekly payment posted in between, that recalculation is made on a smaller balance and less interest is paid. The kicker is that there are 26 biweekly payments in a year which add up to 13 payments instead of 12! That “extra†payment adds up fast and saves you big. In the example below on the mortgage it would be over $71,000 in interest alone! Those savings alone can get a person completely out of other debt that is costing them thousands in interest! It’s an awesome snowball effect!

Folks using our loan acceleration program usually save around 5-8 months on an auto loan and 5-8 years on a mortgage with NO closing fees, upfront fees, refinance fees: ZERO out of pocket. Just a ten minute phone call!

For more information or to enroll in a loan acceleration program, call us 800-385-0743 or complete the quote request found in this website under the loan acceleration tab!