Sandra Valentine: Posted on Saturday, November 30, 2013 11:58 AM

Can too much GOOD credit be BAD? Hmmm????? Sounds like an oxymoron right? Well, surprise, surprise, the answer is YES!

While it is important to establish credit and a positive payment history, like everything else in life, there has to a healthy balance and sometimes too much “good†can actually cause more harm.

While it is important to establish credit and a positive payment history, like everything else in life, there has to a healthy balance and sometimes too much “good†can actually cause more harm.

As president of EZ Credit Repair Now, incorporated in Alabama, (serving nationwide) and have been in the credit and finance industry for 27 years now. I had a client, which we’ll refer to as Jane Doe who sought my services although she had a great credit score. This actual client’s example will serve as a great illustration of how having too much “Good Credit†is not so good.

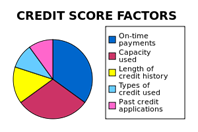

Jane was actually referred to me by another fellow credit repair company after American Express declined her request for a credit line increase. Her credit score was well over 800, so I knew the problem was compositional. (Keep in mind that although lenders look at a potential client’s credit score when weighing a decision of extending credit, they also look at the person’s credit characteristics such as: comparable credit (are they asking for much more than they have proven to be able to handle responsibly for an established amount of time), time of credit activity (how long has this person been in the credit bureau? Is the person a seasoned veteran with a proven payment track record, or someone new to credit? Is the person applying to different lenders (too many inquiries not only hurt your score but show that you’re applying to different lenders at the same time which may result in declination of credit because each lender sees each other’s inquiries and are concerned that the client may be impulsive or has been turned down by other lenders, of which neither is a good thing).

These are just a few key factors to keep in mind and be vigilant for.

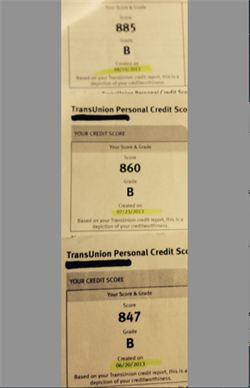

So, getting back to Jane Doe…. After examining her credit composition the problem was obvious. She had previously had about 20-30 open and closed accounts with American Express and various department stores and although all in good standing, that “pendulum activity†is not something potential creditors favor. So after discussing her activity with her we come to discover, that she accepts store credit cards to get the “discount†when she shops, uses the card for a month or two and then closes out the account. Unfortunately, not only is this screaming impulsive!!!!! it also lacks to demonstrate how she can maintain self-control with available credit and doesn’t provide a payment history because she closes the accounts. So what can be done after the damage is caused? I was able to successfully target and remove approximately 30 good/closed credit card accounts off her credit. Targeting is very precise and if not performed by someone who really understands how a credit score is calculated can result in a score drop!

Here’s the proof that in the world of credit: â€LESS IS BETTERâ€.

The lesson: Don’t inquire for credit you don’t need. Rule of thumb is a healthy mix of installment and revolving is needed to reach maximum score optimization. (Having a bunch of credit cards is not enough and too many (more than three) will usually result non favorably.

Revolving credit (credit cards) demonstrate you have self-control as you do not utilize all the credit that is available (PLEASE NOTE: I USED THE WORDS UTILIZE AND CREDIT not SPEND MONEY as credit cards are debt not money) and  installment loans (such as a home or auto) demonstrate that you can make schedule payments on time for a long period of time (ability and stability).

installment loans (such as a home or auto) demonstrate that you can make schedule payments on time for a long period of time (ability and stability).

Be extra cautious at this time of the year. It’s typical for people to seek credit to “meet their shopping expectationsâ€. Don’t allow the peer pressure and stigma attached to the holidays place you in debt and put you in a position where you’ll be paying all next year for this holiday season! Lenders are usually a bit more selective which may result in a declination of credit.

If you do apply for a credit card and get turned down, STOP! Getting declined for credit is a good indicator that your credit bureau is not in balance. There is no need to continue to apply after you have been declined. Before applying for any type of credit, you should first be familiar with your score and composition, utilization ratios, etc….. Then look into the different cards that are offered and select ONE that best matches your need and credit rating instead of going in blindly and requesting credit at different department stores only to find that you were declined 5 different times (and very possibly even by the same lender). Department stores many times use the same lender. For example GE Capital may be the same lender used for Sears, Dillard’s and Rooms To Go. READ before you apply!

Have a safe and Happy Holiday Season!